April has come and gone, and we are now entering our seventh week of practice closures due to Covid-19. Over the last seven weeks, many of us have changed our practice finance approach by shifting to focus on short-term financial needs so we can ensure fiscal viability. Trends indicate that physical distancing and social isolation efforts have been successful in flattening the curve, suggesting that many of us will likely be returning to in-office practice. Some jurisdictions in North America have allowed dental offices to re-open their doors as early as April 27th.

This means that now is the time to adjust your financial mindset and to start thinking about what practice finances will look like when you reopen your doors. We recommend preparing a twelve-month financial forecast to understand the path your practice will follow in returning to normal. Here are some key factors to consider as you’re preparing your projections:

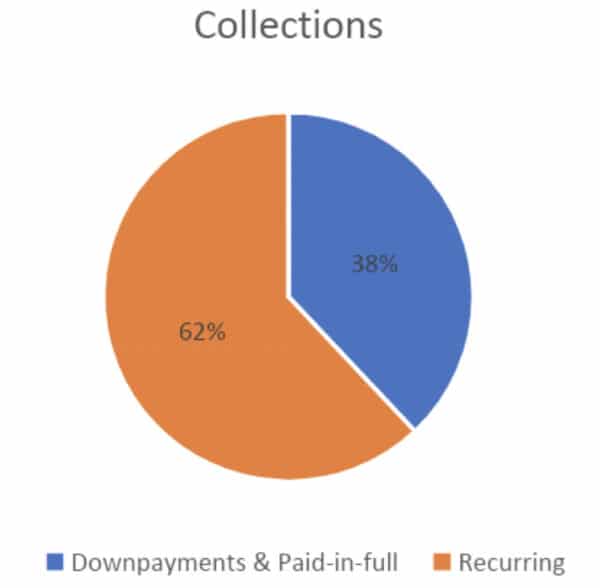

Collections

When we closed our offices on March 16th, we did an analysis of collections across our practices to determine what our recurring monthly revenues were relative to new starts. Here is what we found:

This means that on closing, collections immediately dropped by 38%. The goal during Covid-19 closures was to maintain the remaining 62% through patient outreach. Over the seven weeks of closure we found that approximately 0.93% of patients with recurring payments requested payment accommodations. This attrition combined with natural drop-offs due to completed contracts of 2.42%, results in our current recurring revenues being 58.65%. It’s important for you to understand these numbers as they relate to your practice so that you can properly forecast ongoing payments from pre-Covid-19 starts.

As we look toward reopening, the focus needs to be on maximizing cash receipts, and recovering as much of the 38% drop-off as possible. Scheduling will be imperative during the initial weeks following reopening in order to maximize the recovery of this lost funding source. Key considerations as you build your schedule are:

- Physical distancing measures will significantly reduce the number of patients that you can see each day. It is imperative to optimize patient flow by estimating the number of visits that you can accommodate to maximize cash collections, while providing needed service to existing patients.

- Existing patients are growing accustomed to virtual visits. Identify what types of appointments can continue to be delivered virtually post-reopening and continue to deliver virtual care. By minimizing the number of existing patients that require in-office care you can dedicate more chair time to new starts, which in turn, maximizes cash flow.

- Now is a great time to introduce same day starts into your practice if you have not been doing them routinely before. Starting treatment immediately will result in an accelerated cash injection into your practice and will also free up valuable chair time that would otherwise have been needed for follow-up appointments.

- Expect to find that the number of paid-in-full patients and the size of down payments will decrease. There is still significant uncertainty around economic conditions, meaning patients will likely be much more frugal than they were before the shutdowns.

With all of these factors in mind you should be able to get a good sense of what collections will look like going forward. For further information on Staffing Costs, Personal Protective Equipment, and Deferred Expenses see part 2 of this blog on Tuesday, May 5.